Automated social listening tools transform how brands track and respond to online conversations at scale. These platforms combine real-time monitoring, AI-powered sentiment analysis, and automated alerts to surface critical brand mentions, competitive insights, and customer feedback across multiple social channels simultaneously.

Social media listening involves monitoring and analysing conversations about your brand, competitors, and industry across digital platforms. The automation component eliminates manual tracking by using machine learning to detect patterns, categorise sentiment, and trigger notifications when specific keywords or topics trend.

Modern social listening tools now process millions of conversations daily, filtering noise to deliver actionable intelligence that informs marketing strategy, product development, and customer service priorities.

What Is Automated Social Listening?

Automated social listening refers to using software platforms that continuously monitor social media platforms, forums, review sites, and news outlets for brand mentions and relevant keywords without manual intervention.

Traditional monitoring required teams to manually search platforms and compile reports. Automation replaces this with continuous data collection and analysis.

The technology uses natural language processing to understand context, detect sentiment, and categorise conversations by theme or urgency. This allows brands to track thousands of conversations simultaneously across multiple platforms.

Core Components of Social Listening Automation

Effective automated social listening platforms include several essential features working together. Real-time monitoring captures conversations as they happen across social media platforms.

Sentiment analysis uses AI to determine whether mentions are positive, negative, or neutral. According to Onclusive Social’s advanced AI Sense technology for accurate sentiment analysis, this automated classification helps prioritise which conversations require immediate attention versus routine tracking.

Automated alerts notify teams when specific keywords trend, sentiment shifts dramatically, or conversation volume spikes. These notifications enable rapid response to emerging crises or opportunities.

Multi-platform coverage ensures monitoring extends beyond major networks. Onclusive Social processes over 850 million sources daily, offering coverage including TikTok, Instagram, Threads, and LinkedIn.

How Automation Differs from Manual Monitoring

Manual social monitoring requires team members to regularly check platforms and compile findings. This approach limits coverage and introduces delays between conversations happening and teams discovering them.

Automated social listening tools work continuously, processing conversations 24/7 without human intervention. The software applies consistent criteria for categorisation and prioritisation.

Automation also scales monitoring across far more sources than manual approaches permit. A single tool can track brand mentions across hundreds of platforms simultaneously whilst a manual team might monitor five to ten platforms effectively.

Why Automated Social Listening Tools Matter in 2026

Social media conversations now happen across dozens of platforms simultaneously, creating visibility challenges for brands managing reputation and customer relationships manually.

Customer expectations for response times have compressed. Audiences expect brands to acknowledge feedback within hours, not days.

Automated social listening tools address this by providing real-time visibility into conversations happening across the social media ecosystem, enabling faster response and more informed decision-making.

The Volume Challenge

Brands face an overwhelming volume of social media conversations daily. Major companies may be mentioned thousands of times across platforms, forums, and review sites.

Manually tracking this volume becomes impossible at scale. Automation filters conversations by relevance, sentiment, and urgency, surfacing the discussions that require attention whilst archiving routine mentions for analytics.

This filtering capability transforms noise into signal, allowing teams to focus on conversations that impact business outcomes.

Competitive Intelligence Requirements

Understanding competitor positioning and customer sentiment requires monitoring not just your brand but comparative mentions and industry trends.

Automated tools track competitor mentions alongside your brand, revealing market sentiment shifts, product launch reactions, and gaps in competitor offerings that represent opportunities.

This competitive benchmarking provides context for your brand’s performance, showing share of voice and sentiment comparisons across your market segment.

Crisis Detection and Management

Reputation crises often emerge from social media conversations that escalate rapidly. Early detection allows brands to respond before situations spiral.

Automated monitoring detects unusual spikes in negative sentiment or mention volume, triggering alerts that bring potential crises to team attention immediately.

This early warning system provides critical time for crafting responses and mobilising resources to address emerging issues.

Top Benefits of Automated Social Listening

Implementing automated social listening tools delivers measurable advantages across marketing, customer service, and product development functions.

These benefits extend beyond efficiency gains to include strategic insights that inform business decisions and competitive positioning.

Real-Time Brand Monitoring

Automated platforms provide continuous visibility into brand mentions across social media platforms without requiring team members to manually check each channel.

Real-time monitoring means discovering conversations within minutes of publication rather than hours or days later. This immediacy enables timely responses whilst conversations remain active.

Brands can address customer complaints before frustration escalates, capitalise on positive mentions by engaging supportively, and participate in relevant industry discussions as they unfold.

Enhanced Sentiment Analysis

AI-powered sentiment analysis categorises mentions as positive, negative, or neutral automatically, providing aggregate sentiment metrics across time periods and campaigns.

This automated classification reveals sentiment trends that manual monitoring might miss. Teams can identify which products receive positive feedback, which features frustrate customers, and how sentiment shifts following announcements or incidents.

Sentiment tracking also measures campaign effectiveness by monitoring whether brand perception improves following marketing initiatives.

Improved Customer Engagement

Social listening tools identify opportunities for meaningful customer engagement by surfacing questions, complaints, and discussions where brand participation adds value.

Automated alerts notify customer service teams when mentions require responses, ensuring no customer concerns slip through gaps in coverage.

This systematic engagement approach strengthens customer relationships by demonstrating attentiveness and responsiveness.

Data-Driven Decision Making

Social listening analytics provide quantitative data about customer preferences, pain points, and expectations that inform product development and marketing strategy.

Brands discover unmet needs by analysing recurring customer requests and complaints. Competitive analysis reveals positioning opportunities based on competitor weaknesses.

This intelligence transforms social media from a communication channel into a strategic research tool.

Comparison Table: Best Automated Social Listening Tools

The following table compares leading social listening platforms across key features that matter most for automation, coverage, and analytical capabilities.

| Tool | Multi-Platform Coverage | AI-Powered Features | Real-Time Monitoring | Best For |

|---|---|---|---|---|

| Onclusive Social | 850 million+ sources including TikTok, Instagram, Threads, LinkedIn | Advanced AI Sense sentiment analysis, unlimited searches | Yes, with historical data up to 2 years | Enterprise brands requiring comprehensive coverage |

| Sprinklr | 30+ social channels and millions of online sources | Unified AI-powered analytics dashboard | Yes, with automated alerts | Large organisations needing integrated engagement |

| Brandwatch | Major social platforms plus news and forums | Machine learning sentiment analysis | Yes, with customisable monitoring | Marketing teams focused on consumer insights |

| Hootsuite Insights | Integrated with Hootsuite’s social media platforms | Automated sentiment tracking and reporting | Yes, with scheduling integration | Teams wanting combined listening and publishing |

| Mention | Web, social media, forums, and news sites | Basic sentiment analysis and filtering | Yes, with instant notifications | Small to medium businesses with simpler needs |

Each platform offers distinct advantages depending on organisation size, budget, and specific monitoring requirements. Enterprise solutions provide deeper analytics whilst SMB-focused tools emphasise ease of use and affordability.

Best Automated Social Listening Tools 2026

The social listening market includes dozens of platforms with varying capabilities and pricing structures. The following tools represent the strongest options across different use cases and organisation sizes.

Each tool excels in particular areas, from comprehensive coverage to specific industry applications or integration capabilities.

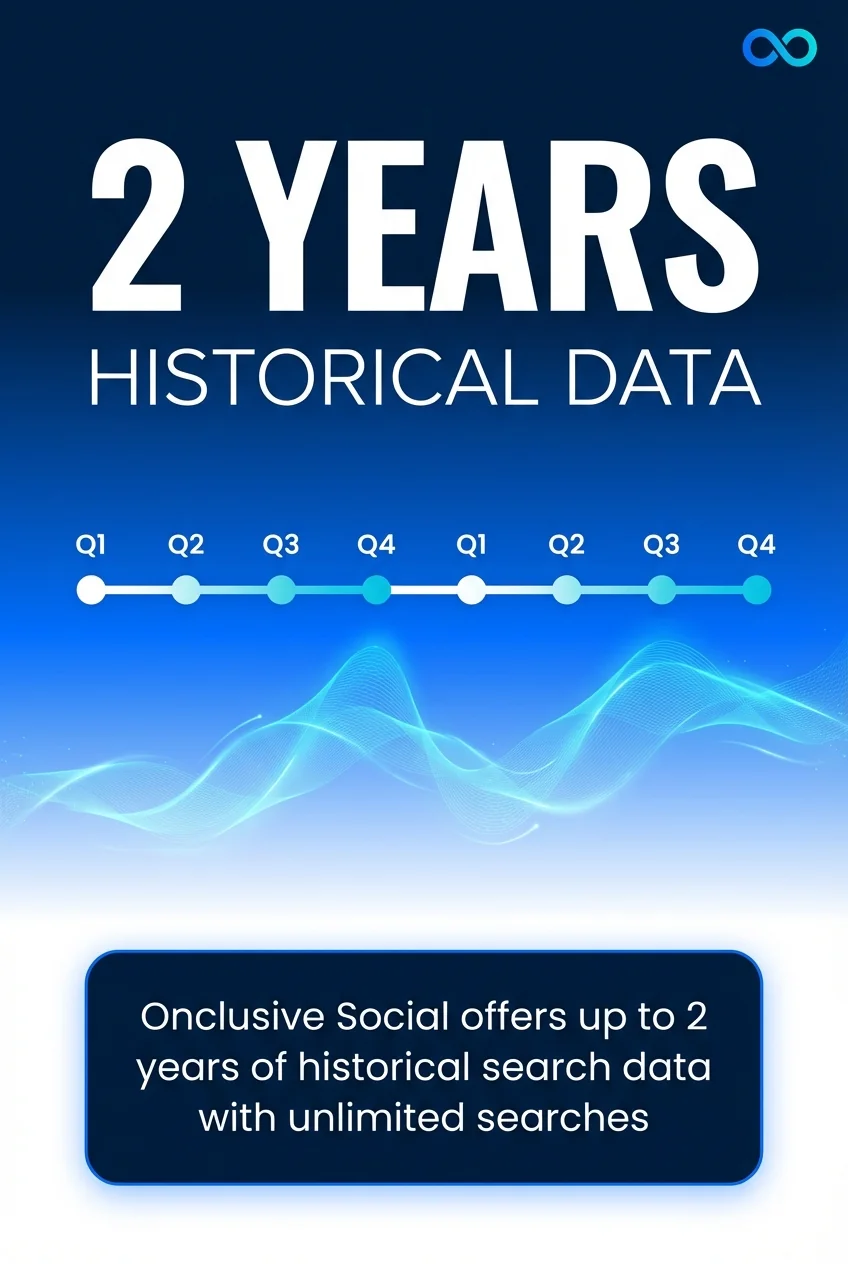

Onclusive Social – Best for Comprehensive Multi-Platform Coverage

Onclusive Social provides the widest monitoring coverage, tracking brand mentions across hard-to-reach platforms that many competitors miss.

Key Features:

- 850 million+ sources monitored daily including TikTok, Instagram, Threads, and LinkedIn

- Advanced AI Sense technology for accurate sentiment analysis

- Up to 2 years of historical search data with unlimited searches

- Real-time alerts for trending topics and sentiment shifts

- Competitive benchmarking and share of voice analytics

Pricing: Enterprise pricing available on request. Custom packages based on monitoring volume and feature requirements.

Pros:

- Unmatched platform coverage including emerging social networks

- Powerful AI-driven sentiment analysis reduces manual categorisation

- Extensive historical data enables trend analysis

- Robust reporting and analytics dashboards

Cons:

- Enterprise pricing may exceed small business budgets

- Feature depth requires learning curve for new users

- Custom implementation needed for complex organisational structures

Best For: Large brands and enterprises requiring comprehensive monitoring across all social media platforms with advanced analytics and competitive intelligence capabilities.

Sprinklr – Best for Unified Customer Experience Management

Sprinklr combines social listening with engagement tools, creating a unified platform for monitoring and responding to customer conversations.

Key Features:

- Coverage across 30+ social channels and millions of online sources

- Unified AI-powered analytics dashboard with customisable views

- Integrated publishing and scheduling alongside monitoring

- Team collaboration features with approval workflows

- Real-time monitoring with automated alert configuration

Pricing: Custom enterprise pricing based on modules and user seats. Typically positioned for mid-market to enterprise organisations.

Pros:

- All-in-one platform reduces tool sprawl

- Strong team collaboration and workflow management

- Comprehensive reporting across listening and engagement metrics

- Scalable across large organisations with multiple teams

Cons:

- Higher pricing tier limits accessibility for smaller teams

- Platform complexity requires dedicated training

- Some users report steep learning curve for full feature adoption

Best For: Large organisations seeking integrated social media management combining listening, engagement, publishing, and analytics in a single platform.

Brandwatch – Best for Consumer Intelligence and Market Research

Brandwatch specialises in deep consumer insights, using AI-powered analytics to reveal audience segments, trends, and sentiment patterns.

Key Features:

- AI-powered audience segmentation and persona analysis

- Trend prediction and forecasting capabilities

- Image recognition for logo and product detection

- Customisable dashboards with advanced visualisation

- Integration with major marketing and CRM platforms

Pricing: Custom enterprise pricing. Mid-market packages available with scaled feature sets.

Pros:

- Exceptional analytical depth for consumer research

- Strong visualisation tools for presenting insights

- Powerful filtering and Boolean search capabilities

- Robust API for custom integrations

Cons:

- Pricing positions it primarily for enterprise budgets

- Data volume limits on lower-tier plans

- Advanced features require analytical expertise to maximise value

Best For: Marketing teams and researchers focused on deep consumer insights, trend analysis, and market intelligence beyond basic brand monitoring.

Hootsuite Insights – Best for Combined Listening and Publishing

Hootsuite Insights integrates social listening with Hootsuite’s established social media management platform, creating seamless workflows between monitoring and engagement.

Key Features:

- Native integration with Hootsuite’s publishing and scheduling tools

- Automated sentiment analysis and conversation categorisation

- Unified inbox for managing social messages and mentions

- Team assignment and workflow automation

- Customisable streams for tracking specific topics or accounts

Pricing: Plans start from £49/month for basic listening features. Enterprise plans with advanced analytics available on request.

Pros:

- Affordable entry-level pricing for small teams

- Seamless integration reduces platform switching

- Familiar interface for existing Hootsuite users

- Strong scheduling and content calendar features alongside listening

Cons:

- Listening features less comprehensive than dedicated platforms

- Limited historical data access on lower-tier plans

- Sentiment analysis less sophisticated than specialist tools

Best For: Small to medium businesses wanting combined social media management and listening without managing separate platforms or budgets.

Mention – Best for Small Business Monitoring

Mention provides accessible social listening for smaller organisations, focusing on essential monitoring features at affordable pricing.

Key Features:

- Real-time monitoring across web, social media, and news sources

- Instant notifications for brand mentions

- Basic sentiment analysis and filtering

- Competitor tracking and comparison

- Simple reporting and analytics dashboards

Pricing: Plans start from £21/month for basic monitoring. Professional and enterprise tiers add advanced features and increased mention limits.

Pros:

- Affordable pricing accessible for small businesses

- Quick setup and minimal learning curve

- Clean, intuitive interface

- Responsive customer support

Cons:

- Limited analytical depth compared to enterprise tools

- Mention limits on lower-tier plans may constrain larger brands

- Fewer integration options with other marketing tools

Best For: Small businesses and solo marketers needing straightforward brand monitoring without complex features or enterprise pricing.

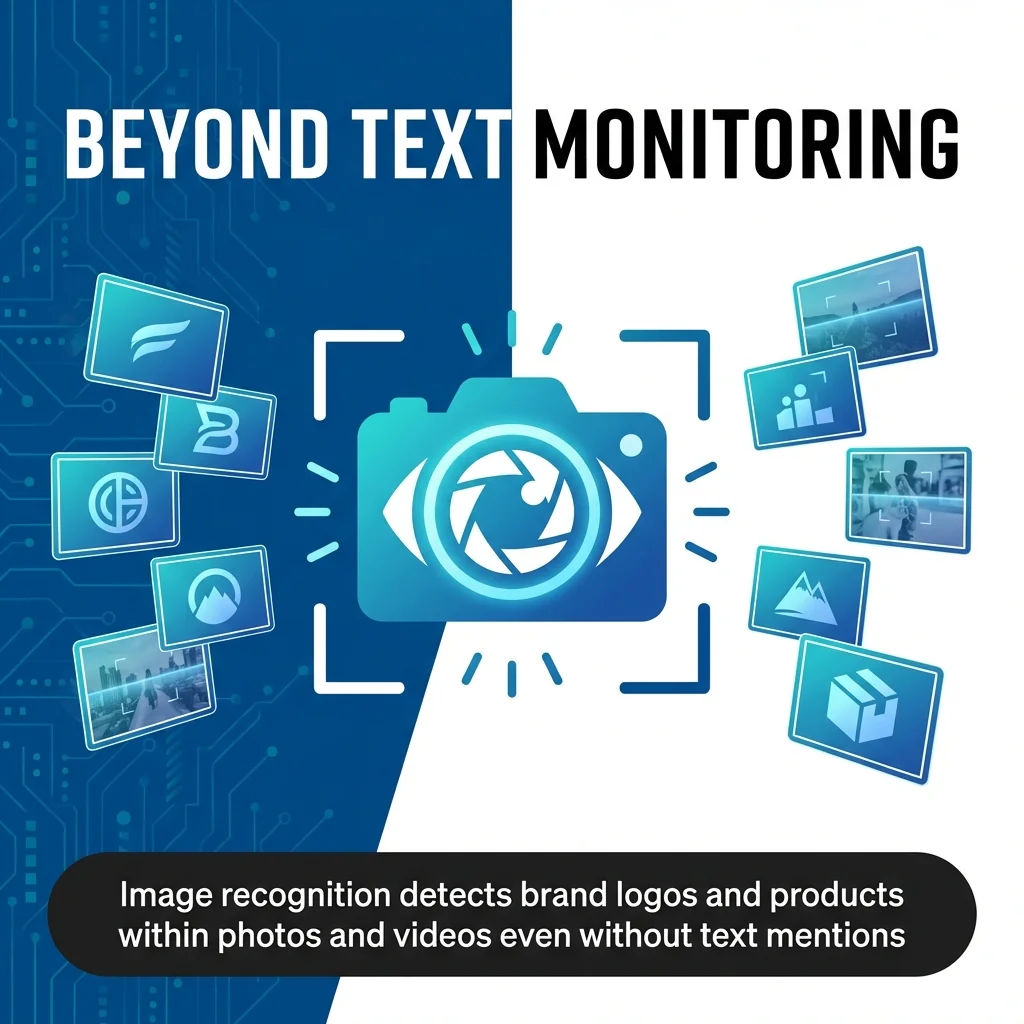

Talkwalker – Best for AI-Powered Visual Listening

Talkwalker combines traditional text-based monitoring with advanced image and video recognition, tracking brand logos and products across visual content.

Key Features:

- AI-powered image and video recognition

- Coverage across 150 million sources globally

- Crisis detection and automated alerts

- Influencer identification and tracking

- Multi-language sentiment analysis supporting 187 languages

Pricing: Enterprise custom pricing based on monitoring volume and feature requirements.

Pros:

- Leading visual recognition capabilities

- Extensive global coverage including non-English sources

- Strong crisis management and rapid response features

- Comprehensive influencer analytics

Cons:

- Premium pricing targets enterprise budgets

- Platform complexity may overwhelm smaller teams

- Implementation requires technical resources

Best For: Global brands requiring visual content monitoring, multi-language support, and advanced influencer tracking alongside traditional text monitoring.

Meltwater – Best for Media Intelligence Integration

Meltwater expands social listening to include traditional media monitoring, providing comprehensive coverage across earned media channels.

Key Features:

- Combined social media and traditional news monitoring

- Real-time alerts for brand mentions across all channels

- Media contact database for outreach

- Competitive intelligence and share of voice tracking

- Custom reporting and analytics dashboards

Pricing: Custom enterprise pricing. Typically positioned for mid-market to enterprise organisations with PR needs.

Pros:

- Unified platform for social and traditional media monitoring

- Strong PR and media relations features

- Comprehensive competitive tracking

- Extensive coverage including international sources

Cons:

- Enterprise pricing model limits small business access

- Feature breadth creates learning curve

- Some users report customer service inconsistency

Best For: Organisations requiring integrated monitoring across social media and traditional news outlets, particularly brands with active PR programmes.

Awario – Best for Affordable Real-Time Monitoring

Awario provides real-time social listening at accessible pricing, focusing on essential monitoring features for budget-conscious teams.

Key Features:

- Real-time monitoring across social media and web sources

- Boolean search for precise query building

- Influencer identification based on reach and engagement

- Sentiment analysis and mention categorisation

- Lead generation features for sales prospecting

Pricing: Plans start from £24/month for basic monitoring. Professional and enterprise tiers add team features and increased limits.

Pros:

- Affordable entry-level pricing

- Quick setup and straightforward interface

- Strong Boolean search capabilities

- Useful sales intelligence features

Cons:

- Limited historical data access

- Fewer integration options than premium platforms

- Basic reporting compared to enterprise tools

Best For: Small marketing and sales teams needing real-time monitoring with lead generation capabilities at budget-friendly pricing.

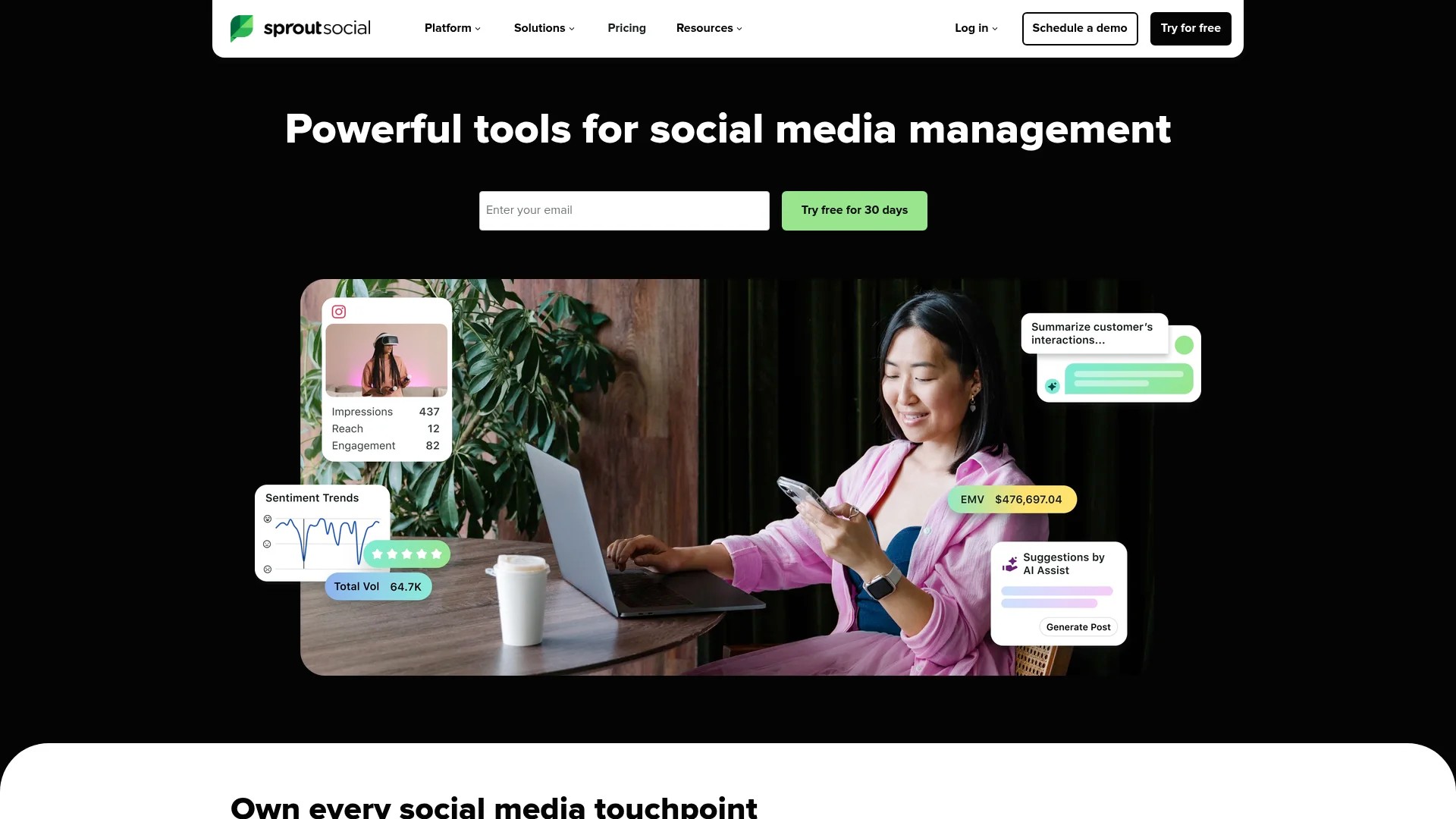

Sprout Social – Best for All-in-One Social Media Management

Sprout Social combines robust social listening with comprehensive publishing, engagement, and analytics features in an intuitive platform.

Key Features:

- Unified social inbox for managing all messages and mentions

- Smart Inbox filters using automation and AI

- Publishing and content calendar with team workflows

- Customisable listening queries and saved searches

- Comprehensive analytics and reporting across all social activities

Pricing: Plans start from £199/month per user. Professional and advanced tiers add listening and reporting features.

Pros:

- Intuitive interface with minimal learning curve

- Strong team collaboration features

- Excellent customer support and training resources

- Unified platform reduces tool switching

Cons:

- Per-user pricing increases costs for larger teams

- Advanced listening features require higher-tier plans

- Some users report occasional platform performance issues

Best For: Marketing teams wanting integrated social media management with listening, publishing, and engagement in a user-friendly platform.

Synthesio – Best for Enterprise-Grade Analytics

Synthesio delivers sophisticated analytics and AI-powered insights designed for large organisations with complex monitoring requirements.

Key Features:

- AI-powered theme detection and topic clustering

- Advanced audience segmentation and persona building

- Custom dashboards with extensive visualisation options

- API access for custom integrations

- Multi-language support for global monitoring

Pricing: Enterprise custom pricing based on requirements and scale.

Pros:

- Sophisticated analytical capabilities

- Highly customisable to organisational needs

- Strong data science and AI features

- Dedicated account management and support

Cons:

- Premium pricing targets enterprise budgets exclusively

- Requires analytical expertise to maximise value

- Longer implementation timeline for custom deployments

Best For: Large enterprises requiring sophisticated analytical capabilities, custom integrations, and dedicated support for complex monitoring programmes.

How to Choose the Right Social Listening Tool

Selecting the appropriate automated social listening platform requires evaluating several factors against your organisation’s specific requirements and constraints.

The right tool balances features, pricing, and usability whilst supporting your monitoring objectives and team capabilities.

Define Your Monitoring Objectives

Start by clarifying what you aim to achieve with social listening. Different objectives require different platform capabilities.

Brand reputation monitoring focuses on tracking mentions and sentiment. This requires comprehensive coverage and sentiment analysis but may not need advanced analytics.

Customer service responsiveness prioritises real-time alerts and unified inbox features. Teams need quick notification of customer issues rather than deep analytical reports.

Market research and competitive intelligence demand sophisticated analytics, trend detection, and comparative metrics. These use cases benefit from platforms with strong reporting and visualisation.

Define your primary objective first, then evaluate tools based on their strengths in that specific area.

Assess Platform Coverage Requirements

Different tools monitor different sources. Verify that candidates cover the platforms where your audience actively discusses your brand.

B2B brands may prioritise LinkedIn and Twitter coverage whilst consumer brands need strong Instagram and TikTok monitoring. According to social media sentiment analysis best practices, platform coverage directly impacts the completeness of your brand intelligence.

Consider emerging platforms where your audience may migrate. Tools with broader coverage provide future-proofing as social media habits shift.

Also evaluate coverage beyond social media platforms. Forums, review sites, and news sources contribute to comprehensive brand monitoring.

Evaluate AI and Automation Capabilities

The quality of AI-powered features varies significantly between platforms. Strong sentiment analysis reduces manual categorisation work.

Test sentiment accuracy by reviewing how tools categorise sample mentions. Some platforms struggle with sarcasm, industry jargon, or context-dependent sentiment.

Automation should extend to alerts, report generation, and routine workflows. Evaluate whether platforms offer customisable automation rules that match your team’s processes. Social media automation tools vary widely in sophistication and flexibility.

Consider whether AI capabilities improve over time through machine learning or remain static. Platforms that learn from corrections provide increasing accuracy.

Consider Team Size and Collaboration Needs

Team collaboration features become essential for organisations with multiple people monitoring or responding to social conversations.

Evaluate whether platforms support assignment workflows, approval processes, and permission controls. Large teams need clear task distribution to avoid duplicate responses.

Pricing models often scale with user seats. Per-user pricing may become prohibitive for larger teams whilst enterprise licensing may offer better value at scale.

Test whether multiple team members can work simultaneously without conflicts. Some platforms handle concurrent usage better than others.

Analyse Integration Requirements

Social listening tools work best when integrated with your existing marketing technology stack. Evaluate what integrations each platform supports.

CRM integration allows social insights to inform customer records and sales processes. Marketing automation connections enable social data to trigger campaigns.

Slack or Microsoft Teams integration brings alerts directly into team communication channels. Dashboard tools like Tableau or Google Data Studio may require API access. According to automation tool selection guidance, integration capabilities often determine long-term platform value.

Verify whether integrations are native or require middleware. Native integrations typically offer better reliability and easier maintenance.

Review Pricing Models and Value

Social listening pricing varies from affordable monthly subscriptions to substantial enterprise contracts. Understanding pricing structures helps identify sustainable options.

Entry-level tools typically range from £20 to £100 monthly. These suit small businesses with basic monitoring needs but may include mention limits or reduced features.

Mid-market platforms range from £200 to £1,000 monthly. These provide more comprehensive features and higher limits without enterprise complexity.

Enterprise platforms require custom quotes, typically starting from several thousand pounds monthly. These offer maximum features, customisation, and support.

Compare pricing against the value delivered. Cheaper tools that miss critical conversations may cost more in missed opportunities than premium platforms that surface every mention.

Test with Free Trials

Most social listening platforms offer trial periods or demonstrations. Use these to evaluate usability and feature performance before committing.

During trials, monitor your actual brand and keywords rather than generic test queries. This reveals how well the platform handles your specific monitoring requirements.

Test key workflows your team will use daily. Verify that alert configuration, report generation, and team collaboration features meet expectations.

Involve team members who will use the platform regularly. Their input about interface usability and feature accessibility proves valuable for long-term adoption.

Essential Features for Effective Social Listening Automation

Whilst platform options vary, certain core features prove essential for effective automated social listening regardless of organisation size or industry.

Prioritising these capabilities during evaluation ensures your selected tool delivers practical monitoring value.

Real-Time Monitoring and Alerts

Timely discovery of brand mentions enables appropriate responses whilst conversations remain active. Real-time monitoring provides continuous visibility.

Alert configuration flexibility allows teams to define notification criteria based on keywords, sentiment, mention volume, or influencer involvement. Customisable thresholds prevent alert fatigue.

Multi-channel delivery for alerts ensures notifications reach team members through their preferred channels. Email, mobile push notifications, and team chat integrations each serve different response patterns.

Accurate Sentiment Analysis

Sentiment analysis quality directly impacts workflow efficiency. Accurate automated categorisation reduces manual review requirements.

Context-aware sentiment detection understands industry terminology and conversational nuance. Generic sentiment engines may misclassify technical discussions or specialised vocabulary.

Confidence scoring helps teams prioritise manual review. Mentions with low confidence scores warrant human verification whilst high-confidence classifications can be trusted.

Comprehensive Reporting and Analytics

Analytics transform raw mention data into actionable insights. Strong reporting features enable teams to identify trends and measure performance.

Customisable dashboards allow different stakeholders to view relevant metrics. Marketing teams may focus on campaign performance whilst customer service tracks response times.

Historical trending reveals patterns over time. Compare sentiment before and after product launches, track mention volume during campaigns, or measure share of voice against competitors.

Exportable reports facilitate sharing insights with stakeholders who don’t access the platform directly. PDF, PowerPoint, and CSV export options support different presentation needs.

Competitor and Industry Tracking

Monitoring extends beyond your brand to include competitive intelligence and industry trends. Understanding the broader conversation context provides strategic advantages.

Competitor tracking reveals their strengths and weaknesses based on audience feedback. This intelligence informs positioning and identifies opportunity gaps.

Industry keyword monitoring surfaces emerging trends before they reach mainstream awareness. Early trend identification enables proactive strategy adjustments.

Share of voice metrics quantify your brand’s visibility relative to competitors. Track whether marketing investments increase your conversation share over time.

Team Collaboration and Workflow Tools

Effective social listening requires coordination between team members. Collaboration features prevent duplicate work and ensure appropriate response routing.

Assignment capabilities distribute mentions to specific team members based on topic, sentiment, or urgency. Clear ownership prevents conversations falling through gaps.

Approval workflows enable review before public responses on sensitive topics. Junior team members can handle routine interactions whilst escalating complex situations.

Internal notes and tagging create knowledge sharing within teams. Document resolution approaches, customer history, or response strategies for future reference.

Advanced Social Listening Strategies

Basic monitoring captures brand mentions, but sophisticated strategies extract deeper value from social listening automation.

These advanced approaches transform monitoring from reactive response into proactive intelligence that drives business decisions.

Audience Segmentation and Persona Development

Social conversations reveal distinct audience segments with different needs, preferences, and behaviours. Analysing these patterns informs targeting and messaging.

Group mentions by demographic characteristics, interests, or sentiment patterns. Identify which audience segments express satisfaction versus frustration.

Develop data-driven personas based on actual conversation analysis rather than assumptions. These personas guide content creation and campaign targeting.

Monitor segment-specific sentiment independently. One product feature may delight one segment whilst frustrating another, requiring nuanced positioning.

Influencer Identification and Relationship Building

Social listening identifies individuals who drive conversations within your industry or audience. Building relationships with these influencers amplifies brand reach.

Track mention patterns to identify accounts frequently discussing your brand or industry. Evaluate their follower count, engagement rates, and audience demographics.

Distinguish between macro-influencers with large followings and micro-influencers with highly engaged niche audiences. Both offer value for different objectives.

Use listening insights to inform outreach. Reference specific content they’ve shared or perspectives they’ve expressed, demonstrating genuine engagement rather than generic outreach.

Product Development Intelligence

Customer feedback within social conversations provides unfiltered product development insights. Feature requests, complaints, and usage patterns guide roadmap priorities.

Identify recurring feature requests by tracking keyword patterns. Quantify demand by mention volume and sentiment intensity.

Monitor competitor mentions for features customers praise or criticise. These insights reveal competitive advantages to emphasise or gaps to address.

Track sentiment before and after product updates. Measure whether changes improve customer satisfaction or introduce new friction points.

Crisis Prediction and Rapid Response

Advanced monitoring detects potential crises before they escalate. Unusual patterns in mention volume or sentiment signal emerging issues.

Establish baseline metrics for normal mention volume and sentiment distribution. Automated alerts trigger when metrics deviate significantly from these baselines.

Create predefined response protocols for different crisis scenarios. Teams can activate appropriate responses quickly when alerts trigger.

Monitor crisis progression through continued tracking. Evaluate whether response efforts successfully address concerns or require strategy adjustments. For detailed crisis management approaches, review sentiment analysis strategies for crisis situations.

Integration with Broader Marketing Strategies

Social listening delivers maximum value when integrated with broader marketing programmes rather than operating as an isolated monitoring activity.

These integration points connect listening insights to concrete marketing actions and outcomes.

Content Strategy Optimisation

Audience conversations reveal which topics generate interest and engagement. These insights guide content creation priorities and messaging approaches.

Identify trending topics within your industry before they reach peak visibility. Create timely content that capitalises on emerging interest.

Analyse which content formats audiences discuss most frequently. Video mentions, infographic shares, or blog post discussions each indicate format preferences.

Track content performance by monitoring mentions and sentiment following publication. Identify which pieces generate positive discussion versus falling flat.

Campaign Performance Measurement

Social listening provides real-time campaign feedback beyond traditional analytics. Conversation analysis reveals how audiences perceive and discuss campaigns.

Monitor campaign hashtags and branded terms throughout campaign lifecycles. Track mention volume, sentiment trends, and conversation themes.

Compare actual conversation topics to intended messaging. Audiences may focus on unexpected campaign elements, revealing messaging effectiveness.

Measure campaign reach beyond owned channels. Track earned media mentions, influencer amplification, and organic audience sharing.

Customer Service Enhancement

Social listening extends customer service capabilities beyond formal support channels. Many customers express frustration or ask questions on social media without directly contacting brands.

Monitor brand mentions for customer service issues even when customers don’t tag official accounts. Proactive outreach demonstrates attentiveness.

Track common support topics to identify documentation gaps or product confusion. Recurring questions signal opportunities for improved onboarding or help content.

Measure public response times and resolution rates. Social listening analytics quantify customer service performance on public channels. Platforms like AI-powered social media analytics tools increasingly incorporate service metrics alongside traditional engagement tracking.

Competitive Strategy Development

Systematic competitor monitoring through social listening reveals strategic opportunities and threats. Track competitor activities, audience reactions, and market positioning.

Monitor competitor product launches and campaign announcements. Analyse audience reactions to identify successful approaches or messaging failures.

Track competitor share of voice over time. Significant shifts may indicate successful initiatives worth investigating or vulnerabilities to exploit.

Identify gaps in competitor offerings based on customer complaints or feature requests. Position your solutions to address these unmet needs.

Implementation Best Practices

Successful social listening requires more than tool selection. Implementation approaches determine whether monitoring delivers practical value or generates unused data.

These practices ensure your team extracts maximum value from automated social listening investments.

Define Clear Keyword Strategies

Monitoring effectiveness depends on well-defined keyword queries. Too narrow misses relevant conversations whilst too broad creates noise.

Start with obvious branded terms including company name, product names, and common misspellings. Include branded hashtags and executive names for comprehensive brand coverage.

Add industry keywords and topics relevant to your business. Monitor conversations where your brand should participate even if not explicitly mentioned.

Use Boolean operators to create precise queries. Combine terms with AND operators whilst excluding irrelevant contexts with NOT operators.

Regularly review and refine queries. Initial keyword lists require adjustment as you discover missed conversations or excessive irrelevant mentions.

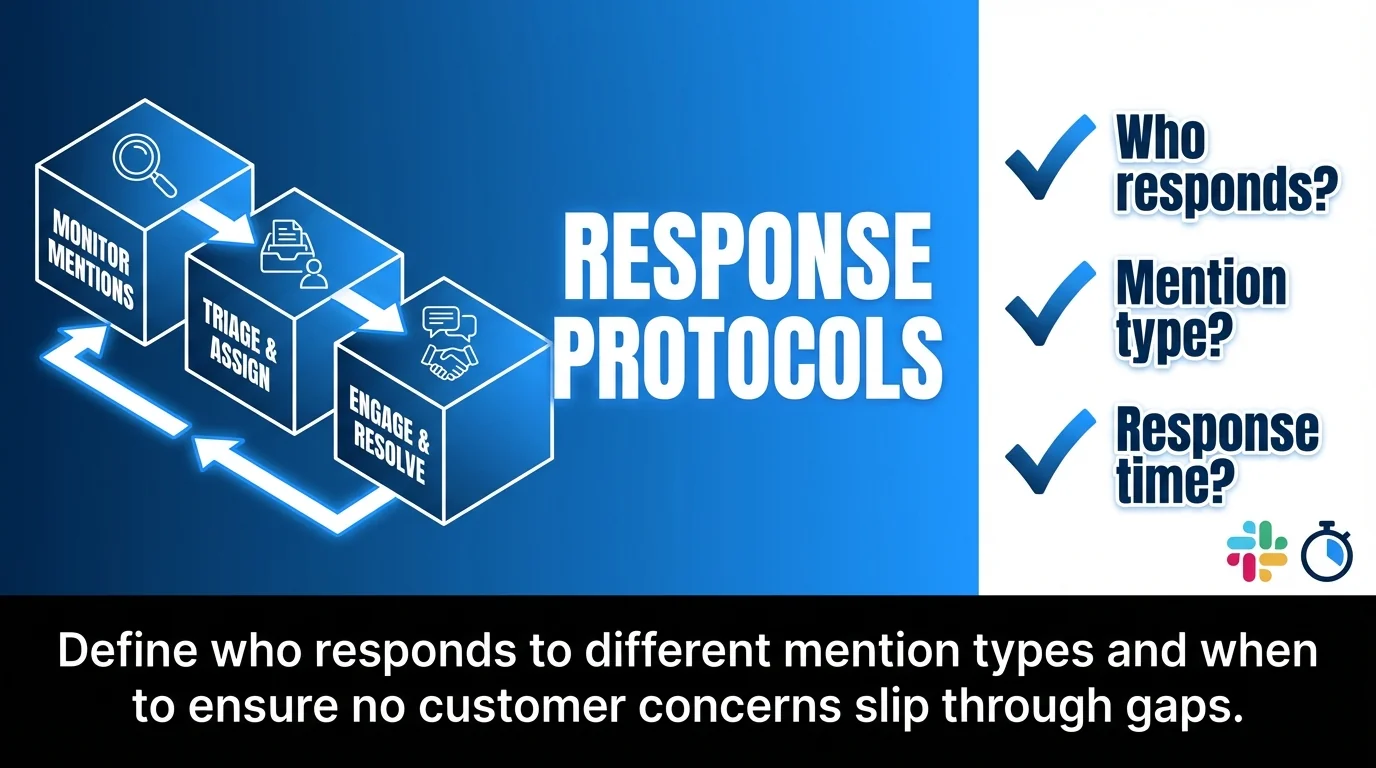

Establish Response Protocols

Discovering mentions without clear response protocols wastes monitoring value. Define who responds to different mention types and when.

Create response time expectations based on mention urgency and sentiment. Customer complaints may require responses within one hour whilst positive mentions can be acknowledged within 24 hours.

Document approved response approaches for common scenarios. Templates for frequent situations ensure consistent brand voice whilst allowing personalisation.

Define escalation paths for sensitive situations. Identify which topics require management approval before public response.

Train Teams Thoroughly

Platform features remain unused without proper team training. Investment in comprehensive training maximises tool adoption and effectiveness.

Provide role-specific training focusing on features each team member uses regularly. Customer service teams need response workflow training whilst marketing teams focus on analytics.

Create internal documentation covering common tasks and troubleshooting. Reduce dependence on vendor support for routine questions.

Schedule regular refresher training as platforms add features. Continuous learning prevents teams from developing inefficient workarounds for problems solved by newer capabilities.

Measure and Optimise Continuously

Social listening programmes require ongoing optimisation. Regular measurement identifies improvement opportunities and demonstrates programme value.

Track key performance indicators aligned to monitoring objectives. Response times, sentiment trends, mention volume, and share of voice each measure different aspects.

Review metrics monthly to identify patterns and anomalies. Investigate significant changes to understand underlying causes.

Solicit team feedback about workflow efficiency and tool usability. Frontline users often identify improvement opportunities missed by management.

Benchmark performance against industry standards when available. External comparison provides context for internal metrics.

Common Challenges and Solutions

Organisations implementing automated social listening encounter predictable challenges. Understanding these obstacles and proven solutions accelerates successful adoption.

Data Overload and Noise

Comprehensive monitoring generates overwhelming mention volumes. Without proper filtering, teams drown in irrelevant data whilst missing critical conversations.

Solution: Implement sophisticated filtering using sentiment thresholds, source prioritisation, and influencer scoring. Focus attention on high-priority mentions whilst archiving lower-priority data for analysis.

Create tiered alert systems. Critical mentions trigger immediate notifications whilst less urgent conversations appear in daily digests.

Use AI-powered topic clustering to group related mentions. Review clusters rather than individual mentions to identify significant patterns efficiently.

Sentiment Analysis Inaccuracy

Generic sentiment engines misclassify industry-specific terminology, sarcasm, and context-dependent language. Inaccurate categorisation wastes time on manual review.

Solution: Select platforms offering customisable sentiment models trained on your industry. Some tools allow manual corrections that improve future accuracy through machine learning.

Focus on confidence scores rather than treating all automated classifications equally. Review low-confidence mentions manually whilst trusting high-confidence assessments.

Accept that sentiment analysis provides directional accuracy rather than perfect classification. Use it for trending analysis rather than absolute precision.

Cross-Team Coordination Difficulties

Social listening insights benefit multiple departments, but coordination challenges prevent effective information sharing.

Solution: Establish clear ownership and communication protocols. Designate a monitoring coordinator who distributes relevant insights to appropriate teams.

Create customised dashboards for different departments. Marketing, customer service, and product teams each need different views of listening data.

Schedule regular cross-functional reviews of listening insights. Monthly meetings ensure all stakeholders stay informed about important trends and conversations.

Demonstrating ROI

Quantifying social listening value challenges organisations, particularly when benefits appear qualitative or indirect.

Solution: Track specific outcomes influenced by listening insights. Document cases where monitoring prevented crises, identified product improvements, or influenced content strategy.

Measure efficiency gains through reduced manual monitoring time. Calculate hours saved through automation compared to previous approaches.

Link listening insights to concrete business metrics. Show correlations between sentiment improvements and customer retention, or between early trend detection and successful campaign performance.

Future Trends in Automated Social Listening

Social listening technology continues advancing rapidly. Understanding emerging trends helps organisations prepare for next-generation capabilities.

Predictive Analytics and AI Enhancement

Current platforms primarily report what has happened. Next-generation tools increasingly predict what will happen based on conversation patterns and historical data.

Machine learning models trained on historical data identify early indicators of viral trends, sentiment shifts, or emerging crises before human analysts notice patterns.

Predictive sentiment forecasting estimates how current conversations may evolve. Brands can proactively adjust strategies before sentiment deteriorates.

For organisations exploring AI capabilities, AI-powered efficiency tools increasingly incorporate predictive features alongside traditional monitoring.

Expanded Platform Coverage

Social media fragmentation continues as new platforms emerge and audiences distribute across more channels. Monitoring coverage must expand accordingly.

Tools increasingly incorporate emerging platforms alongside established networks. Early coverage of new platforms provides competitive advantages as audiences migrate.

Private community monitoring grows as conversations shift from public social networks to closed groups, Discord servers, and membership platforms.

Enhanced Visual and Audio Monitoring

Text-based monitoring misses growing volumes of visual and audio content. Advanced platforms increasingly analyse images, videos, and podcasts for brand mentions.

Image recognition detects brand logos and products within photos and videos even without text mentions. This captures organic brand appearances in user-generated content.

Audio transcription and analysis extends monitoring to podcasts, Clubhouse conversations, and Twitter Spaces. Spoken brand mentions complement text tracking.

Privacy and Ethical Considerations

Increasing privacy awareness affects social listening practices. Platforms must balance comprehensive monitoring with ethical data collection and usage.

Regulatory compliance features help organisations monitor whilst respecting GDPR, CCPA, and other privacy regulations. Automated data retention policies and consent management become standard.

Ethical guidelines around monitoring employee social media, competitive intelligence boundaries, and audience privacy expectations continue evolving. Tool selection increasingly considers privacy compliance capabilities.

Taking Action with Automated Social Listening

Automated social listening transforms how organisations understand and engage with audiences. The right platform provides continuous visibility into brand conversations, competitive dynamics, and market trends.

Success requires matching tool capabilities to specific objectives. Enterprise brands benefit from comprehensive platforms like Onclusive Social, whilst smaller organisations find value in accessible options like Mention or Hootsuite Insights.

Implementation extends beyond tool selection. Effective listening programmes combine technology with clear protocols, trained teams, and integration with broader marketing strategies.

Start by defining monitoring objectives clearly. Understand what you aim to achieve, then evaluate platforms based on their strengths in those specific areas.

Test platforms thoroughly using actual brand queries during trial periods. Verify that alert configuration, sentiment accuracy, and workflow features meet practical requirements.

Build monitoring into regular marketing rhythms rather than treating it as an isolated activity. Share insights across teams, connect listening data to strategic decisions, and continuously refine approaches based on results.

The brands gaining maximum value from social listening treat it as ongoing intelligence gathering rather than a set-and-forget monitoring task. Regular optimisation, team training, and strategic integration separate successful programmes from abandoned tools.

Social media conversations contain valuable signals about customer needs, competitive positioning, and market opportunities. Automated listening technology makes capturing and acting on these signals practical at scale.